(Podcast) Property Investments Insights with James Pastras: Building Wealth in 2025

- Jul 15, 2025

- 3 min read

Updated: Aug 6, 2025

In this special segment on 3AW, James Pastras (CEO, Raine & Horne Properties & Investments) joins industry leader Randolph Clements to unpack:

✅ Why property remains one of the most resilient long-term strategies

✅ How to get started using equity — not just cash

✅ The real difference between high-risk and high-growth properties

✅ What most first-time investors get wrong

Whether you're a seasoned investor or just considering your options, this conversation offers fresh insights grounded in experience.

📈 The right knowledge can shift your future.

🎧 Listen to the full interview now — and start thinking like an investor.

Book your FREE investment consultation today and let’s explore how you can start building wealth through property—even if you’re starting small.

You can arrange your free consultation online by choosing a date & time that suits you.

Key Talking Points of this Podcast

1. Who Is Considered a Property Investor?

Anyone buying a property (residential or commercial) is an investor from day one.

It's not limited to experienced or full-time investors.

2. First Steps for Investing

Step 1: Book a consultation with experts like Raine & Horne.

They help assess your goals and needs.

Step 2: Analyze finance options with help from brokers, accountants, and advisors.

Equity from your home can often be used instead of cash.

3. Investment Structure & Strategy

Interest-only loans are common. They allow for lower weekly out-of-pocket costs after tax and rental income.

A $600,000 property could cost just $100–$150/week with proper structuring.

Emphasis on capital growth, tax benefits, and rental demand when selecting a property.

4. Residential vs Commercial Property

Residential is preferred by James: newer homes and townhouses in growth suburbs.

These properties are easier to maintain, have strong rental demand, and better capital growth.

Commercial properties have benefits (tenants cover outgoings), but they come with higher risk and complexity.

5. Government Schemes & Financial Discipline

Government programs (like 5% deposits) can help, but investors must still cover repayments on 95%.

A "fighting fund" is advised: Save at least 6 months of expenses before investing.

This fund covers vacancy, maintenance, or unexpected costs.

6. The Long-Term View

Property generally doubles in value every 10–12 years — if purchased well.

Don’t get emotionally attached; treat it like a business.

Buy based on numbers, not personal preferences.

7. Common Mistakes & Myths

Myth: "Property always goes up." Truth: Long-term yes, but it fluctuates.

Mistake: Buying inner-city apartments.

- These often have low capital growth due to oversupply and high body corporate fees.

- Better options include landed properties in growth suburbs.

8. The Ideal Investment Property

Brand new homes and townhouses in outer growth areas are ideal.

They are eligible for stamp duty concessions.

These properties offer depreciation benefits and builder warranties.

They are easier to rent and appeal to a wider pool of tenants.

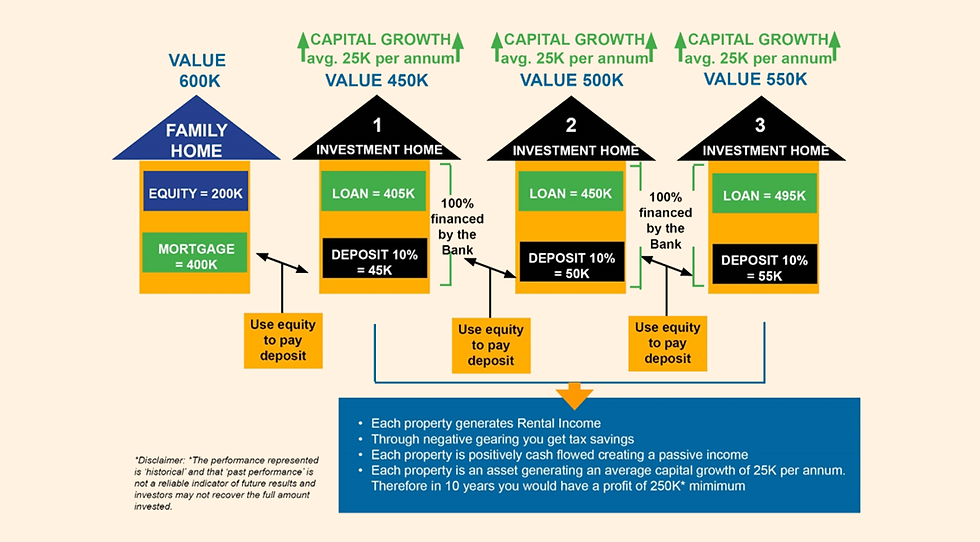

📈 Investment Growth Strategy

Start with one property.

As it appreciates, use the equity to purchase the next one.

Build a portfolio gradually for long-term financial freedom.

✅ Summary Advice for New Investors

Get expert guidance early.

Use your home equity wisely.

Buy for capital growth, not emotion.

Avoid inner-city apartments as first investments.

Save a safety buffer before buying.

Choose brand new, low-maintenance properties with strong rental demand.

Think long-term — real wealth comes with time and strategy.

Conclusion

Investing in property can be a rewarding journey. With the right knowledge and strategy, you can build a sustainable portfolio. Remember to seek expert advice and approach your investments with a clear plan. The potential for growth is significant, and with patience, you can achieve your financial goals.

Comments