Property Investment: The Key to Financial Security in Uncertain Times

- Jun 23, 2025

- 3 min read

Updated: Jul 10, 2025

In a world increasingly defined by economic uncertainty, inflation, geopolitical conflict, and rising living costs, many Australians are left wondering how to protect their finances and grow them. The stock market is volatile, interest rates are shifting, and traditional savings accounts offer little return. So where does that leave everyday individuals seeking long-term financial security? The answer: property investment.

Real Estate: A Time-Tested Wealth Builder

While no investment is entirely risk-free, residential property remains one of the most resilient and rewarding asset classes—especially during economic downturns. Why? Because people will always need a place to live.

Throughout history, real estate has outperformed many other investment types over the long term. Property prices may dip during short-term fluctuations, but they tend to rise steadily over time. When you invest wisely, you’re not just buying a house; you’re buying an appreciating asset that generates rental income and builds equity.

Why Property Makes Sense in Uncertain Times

1. Stability in Volatility

Unlike shares or crypto, the property market doesn’t swing wildly day to day. Even in times of war, inflation, or economic crisis, well-located properties tend to hold their value and recover faster than more speculative assets.

2. Long-Term Capital Growth

Australian property, particularly in key cities like Melbourne, Sydney, and Brisbane, has shown consistent capital growth over decades. Investing during a downturn often means buying below market value—giving you a head start as the market rebounds.

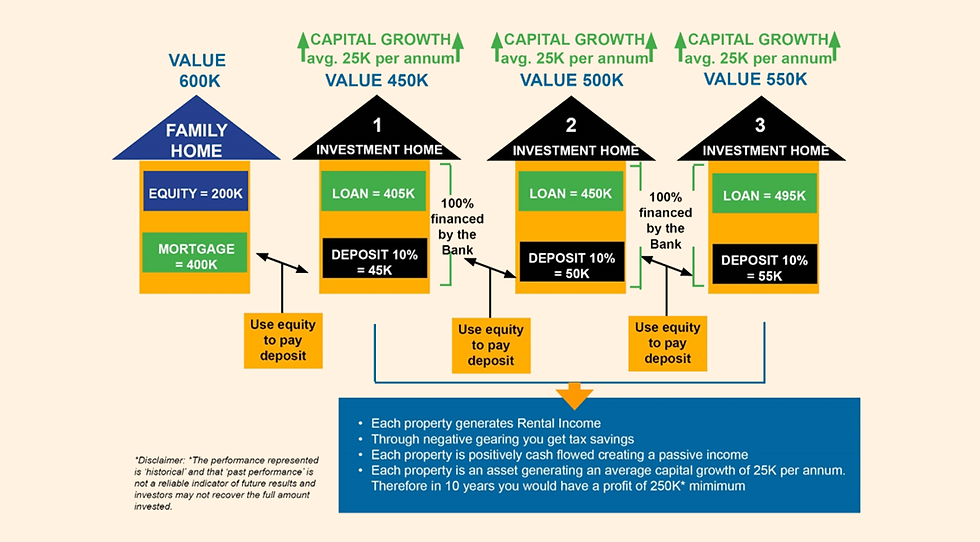

3. Leverage and Tax Efficiency

One of the most powerful advantages of property is the ability to use leverage—your deposit plus the bank’s money—to control a large asset. Add to that the tax benefits available through negative gearing, depreciation, and deductions, and your investment can often cost less per week than you think.

4. A Hedge Against Inflation

As prices rise, so do rents. Owning an investment property allows you to stay ahead of inflation by increasing rental income while your fixed mortgage costs remain steady (if locked in).

But What About Today’s Challenges?

Interest rates have slightly dropped. Yes—living costs are high. However, these challenges also come with opportunities. Smart investors aren’t waiting for perfect conditions. They’re making calculated moves now, taking advantage of:

Equity in their existing home

Government incentives for new builds or first-time investors

Rising rental demand in key growth corridors

Professional guidance from experienced property consultants

The Importance of Market Research

Understanding market trends is crucial when it comes to property investment. Keeping an eye on growth corridors, infrastructure development, and employment rates can guide your decisions. For example, investing in areas with upcoming transport links can increase the property value over time.

Additionally, local demographic shifts—such as population growth or an influx of businesses—can significantly impact property demand. Researching these factors is essential for making informed decisions.

How We Help You Build Wealth—Safely and Strategically

At Raine & Horne Properties and Investments, we’ve helped hundreds of Australians turn everyday income into long-term wealth—without sacrificing their lifestyle. Our proven 3-step strategy focuses on:

Minimising tax (so more of your money works for you)

Paying off your mortgage faster (freeing up cash flow)

Using leverage to build a property portfolio (even starting from just one)

And we do this without gimmicks, high-pressure sales tactics, or get-rich-quick promises. Just smart strategy, tailored advice, and a roadmap that fits your personal situation.

Your Next Step: Book a Free Consultation

If you’re serious about securing your financial future—even in today’s unpredictable world—now is the time to act. It starts with a conversation. No cost. No obligation. Just real insights.

Book your FREE investment consultation today and let’s explore how you can start building wealth through property—even if you’re starting small.

You can arrange your free consultation online by choosing a date & time that suits you.

Comments