Wealth Creation Through a Simple Investment Strategy

- Praful Albuquerque

- Jun 18, 2025

- 2 min read

By Praful Albuquerque

Building wealth is simple! This may sound a bit ridiculous but the reality is that you do not require a lot of money to create wealth nor any luck, genius or special connections. Nor do you need to attend any expensive financial seminars to learn any tricks or gimmicks!

We at Raine & Horne Properties and Investments show you a very simple and sure way of creating wealth through a very sound investment strategy. Our strategy involves 3 ways of creating wealth, which are:

1. Tax Minimisation

2. Paying off your Mortgage Faster

3. Leveraging and building a property portfolio.

Tax Minimisation & Paying off your Mortgage Faster

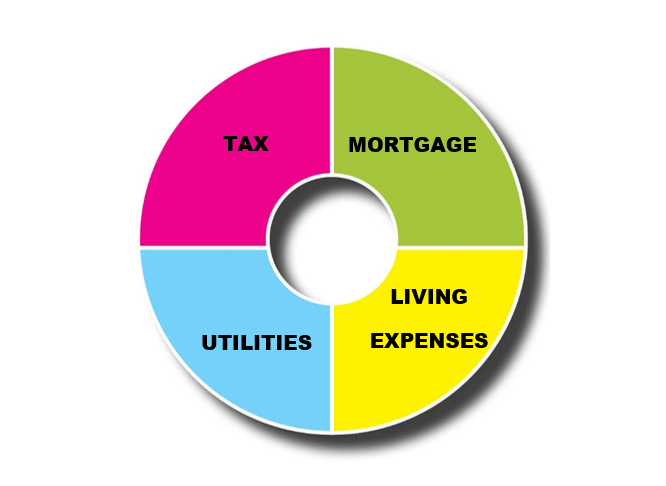

For most Australian households with a mortgage their monthly spend looks something like this:

If you did an analysis of your monthly budget you will realize that almost 40 - 50% or more of your income is spent on Tax and mortgage. This literally means and may sound disturbing but 40 - 50% of your time you are actually working for the bank or the tax man! This is exactly where the problem lies as you are working hard and giving away a substantial portion of your income to the bank and the taxman. The solution is Not to work hard but to work smart!

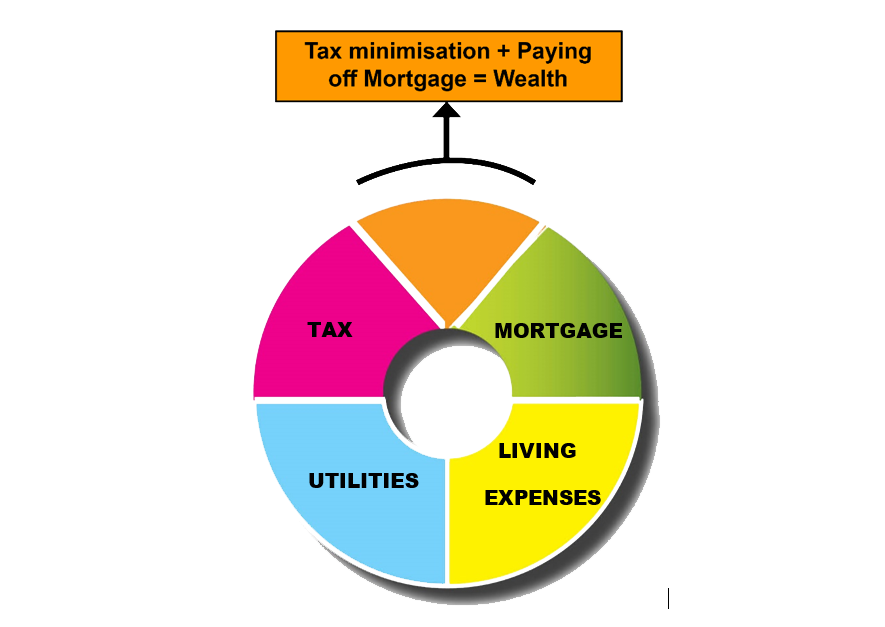

The investment strategy we provide will help you minimise tax, pay of your mortgage faster and start building a property portfolio using your tax dollars. All of this is legal and will not affect your current lifestyle but to the contrary help you improve your lifestyle and secure your financial future.

From the above chart, you will see that by saving a portion of your tax and paying off your mortgage faster, you are now starting to create wealth for you and your family.

Leveraging

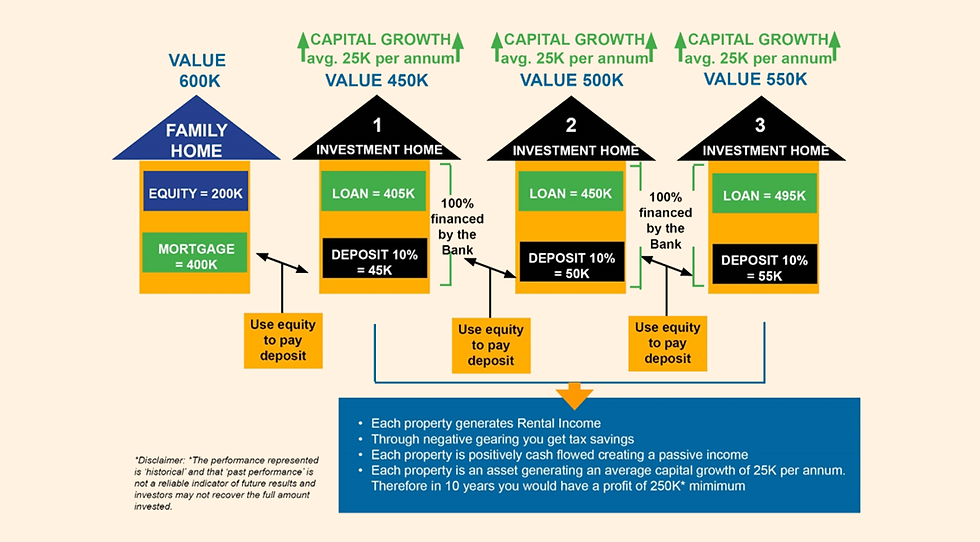

When it comes to wealth creation, leveraging is an extremely powerful tool, and the term simply means using borrowed capital to generate income. When it comes to property investment, it is using your equity and borrowed income to build assets as illustrated in the image below. Using leverage, you are able to build an asset portfolio without having to invest large sums of your own money. See the illustration below on how to use leveraging to build a property portfolio.

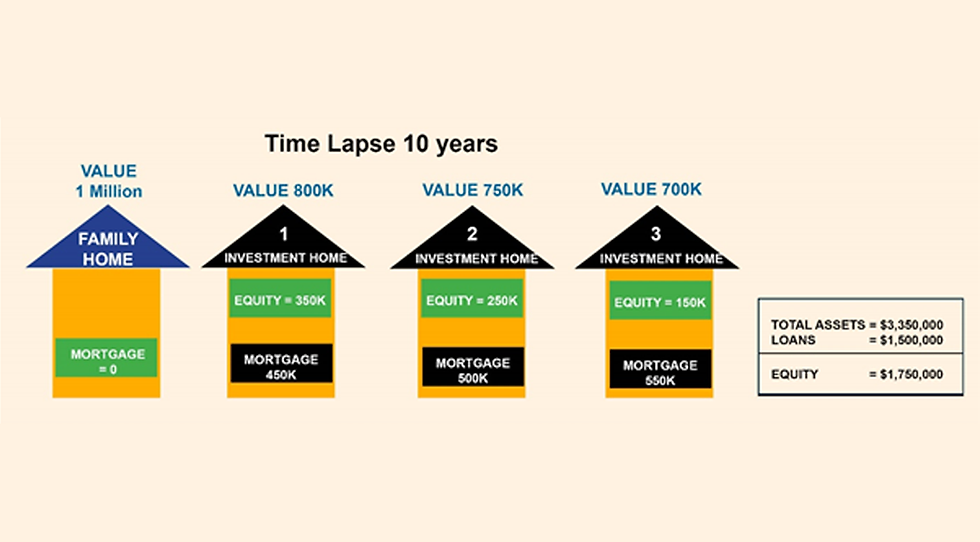

Now, fast forward 10 years, and your property portfolio will look something like this. By leveraging, you have built equity in all your properties, which is actual wealth and ready cash at your fingertips. This can then be used to pay of your Mortgage and become Mortgage Free!

The common myth is that you need a lot of money to invest. However if you have equity in your home then you have sufficient capital to start your investment journey!

If you're serious about building wealth through property, don’t go it alone.

Want tailored insights for your financial situation?👉 Book your free investment consultation with our team at Raine & Horne Properties and Investments.

You can arrange your free consultation online by choosing date & time that suits you.

Comments